Third Party Payment Processors Examples

Instead of buying a separate payment gateway and merchant.

Third party payment processors examples. The most suitable service will depend on your business needs. Home business ideas some third party payment processors examples. Third party payment processors examples. Traditionally processors contracted primarily with retailers that had physical locations in order to process the retailers transactions.

Other disadvantages of third party payment processors is that transaction fees are high sometimes as much as 3 percent a lack of customer service and they may make your business appear less professional. Some third party payment processors examples. Company platform location 2c2p. When it comes to running a business accepting payments is a huge part of it.

They range from established ones such as amazon pay and paypal to small ones like nochex. Key takeaways a third party transaction often involves a seller a buyer and an additional party not connected to the others. Third party payment processors are incredibly popular with online sellers and start ups as they re quick flexible and at least initially cheap. The big benefit of third party processors is simplicity.

Here are some of the requirements for a payment processor. There are hundreds if not thousands of third party payment processors on the market. Nonbank or third party payment processors processors are bank customers that provide payment processing services to merchants and other business entities. Fraud misuse and lack of security are the most common risks associated with third party payment processors.

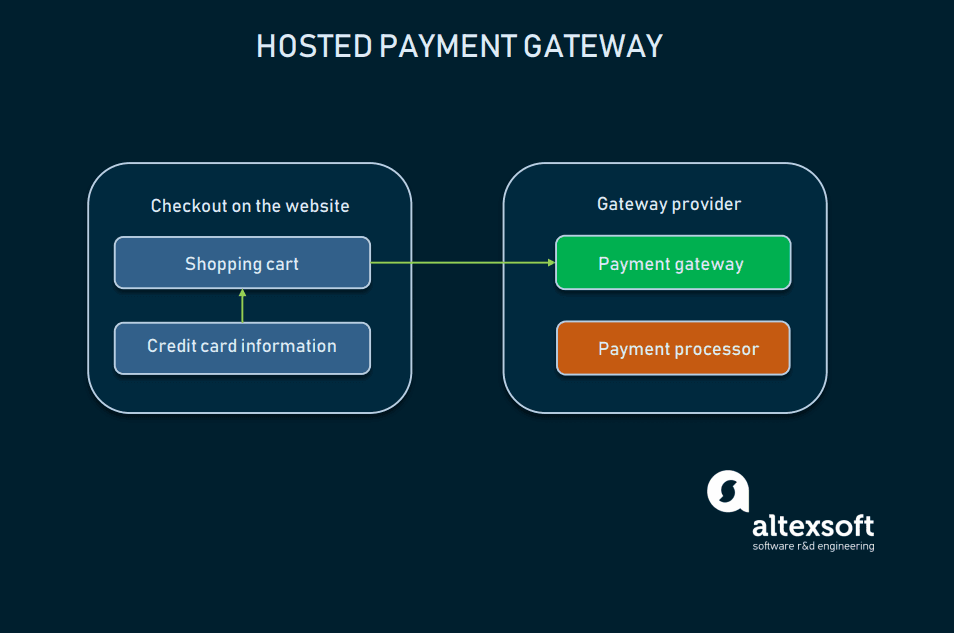

The payment is run through paypal and is thus a third party transaction. In this section i ve expanded a couple of the main advantages. There are thousands of payment processors in the u s. A third party payment processor is a merchant services provider that helps you receive payments from your customers without first setting up your own merchant account with a bank.

The best most suitable service will depend on your needs. The following is a list of notable online payment service providers and payment gateway providing companies their platform base and the countries they offer services in. Therefore you want to be sure that you are choosing a payment processor that is going to assist you in the success of your business rather than hinder. Global headquarters in the netherlands.